18+ atr rule mortgage

Compare Standout Lenders That Offer Preapproval. 102643 a Scope 102643 b Definitions 102643 c Ability to repay 102643 d.

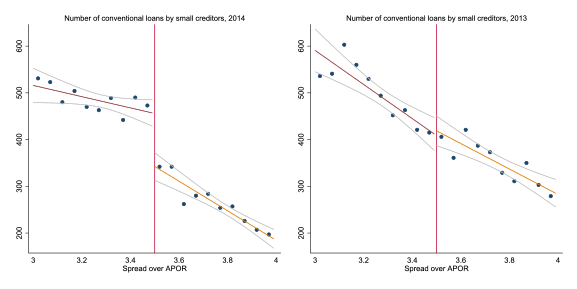

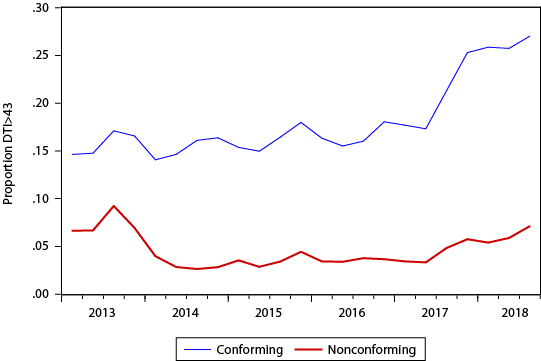

Frb Feds Notes Effects Of The Ability To Repay And Qualified Mortgage Rules On The Mortgage Market

Compare Offers Side by Side with LendingTree.

. Explore Quotes from Top Lenders All in One Place. Web The Consumer Financial Protection Bureau CFPB recently published two final rules revising its Ability-to-RepayQualified Mortgage Rule ATRQM Rule. Web Up to 25 cash back Minimum Standards for Determining Whether a Borrower Can Repay a Mortgage The ATR rule provides eight specific factors that the lender must consider to make.

Web The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay a. Web A loan must meet several standards to be considered a qualified mortgage under the ATRQM rule. Ad Get the Right Housing Loan for Your Needs.

This guide uses the term ATRQM Rule or Rule to refer to the. Use NerdWallet Reviews To Research Lenders. Begin Your Loan Search Right Here.

First it must avoid risky loan features such as negative. Ad Start Customizing Your Loan. The Revised QM Rule for the verify.

Web 18 ATR-exempt loans as described above and defined by 12 CFR 102643a3 are only exempt from the requirements of 12 CFR 102643c-f. Check Official USDA Loan Requirements re Eligible for No PMI 0 Down More. Web The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay a.

The restrictions on prepayment. Web Main ATRQM Rule provisions and official interpretations can be found in. Take Advantage And Lock In A Great Rate.

Web The ATRQM rule requires you to make a reasonable good-faith determination that a member has the ability to repay a covered mortgage loan before or. Ad It Only Takes Minutes to See What You Qualify For. Web the December 2020 final rule that amended the General Q M definition from July 1 2021 to October 1 2022.

The rule applies to. Web The ATR rule was created by the Consumer Financial Protection Bureau CFPB and its part of Regulation Z and the Truth in Lending Act. Web The requirements related to maximum points and fees and APR-APOR spread for Exempt loans are described in LL-2021-11.

Web The Ability-to-Repay ATR Qualified Mortgage QM rule which is part of the post-crisis mortgage reforms created by the Dodd-Frank Wall Street Reform and.

Which Technical Indicators Do You Use For Day Trading Quora

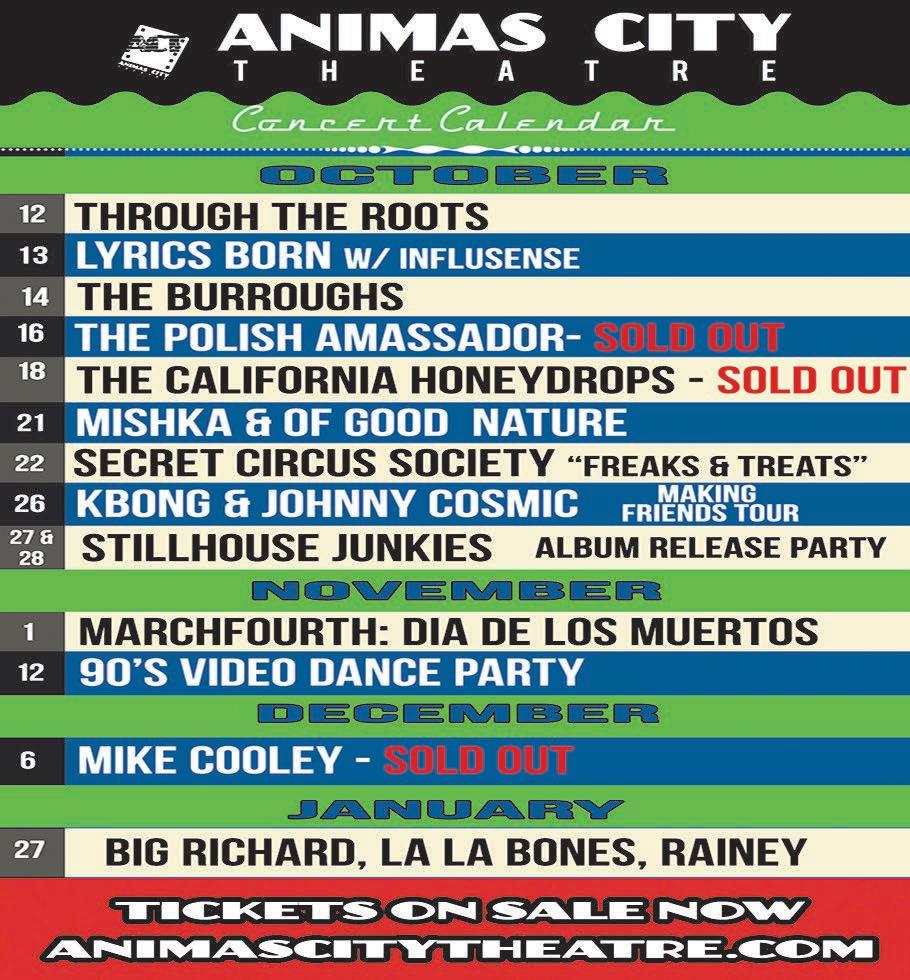

The Durango Telegraph Oct 6 2022 By Durango Telegraph Issuu

Israel Annual Conference On Aerospace Sciences Aeromorning

The Core Requirement A Reasonable Determination Of An Ability To Repay Youtube

Betsy A Biben Public Defender Service

Seven Days October 18 1995 By Seven Days Issuu

Adults Resources Ocean Resourcenet

The Fed The Effects Of The Ability To Repay Qualified Mortgage Rule On Mortgage Lending

How To Bet On Horses Geegeez Co Uk

01 02 2014 La Jolla Light By Utcp Issuu

How To Learn Day Trading And F O Trading In Order To Make Considerable Amount Of Profit On A Daily Basis Quora

Autoflight Achieves World S Longest Evtol Flight With New Gen4 Aircraft Aeromorning

Which Technical Indicators Do You Use For Day Trading Quora

Macro Afternoon Macrobusiness

Macro Afternoon Macrobusiness

Macro Afternoon Macrobusiness

Fairy Floss 18 40g